Redefining relationships between people, places, and property

Mortar is a technology company building better services. Our products and solutions are driving the next generation of intelligent, accessible, user-led services.

Learn about our workCase studies

Mortar is trusted by government, health and housing institutions to solve complex problems impacting services and communities. Our product Hoop'd supports the transformation of services, applying new technologies to deliver local, bespoke, user-led solutions.

Supporting tenants for the Mayor of London

Custom case management platform delivering advice, triage and referral for those at risk of losing their home.

Reducing school exclusions in Cheshire

Tailored assessments supporting teachers in signposting families and young people to appropriate services.

Reaching digitally excluded residents in East Riding

A custom version of our Triage Tool, building regional digital inclusion networks and skills campaigns.

Triage and signposting tool for Salford

Tailored triage for assessing resident need, supporting a place-based approach to digital inclusion.

Our Solutions

We combine our most successful work into scalable solutions, making them personalised and tailored to the needs of your users.

Community navigator

Build and manage your local network to deliver accurate, up-to-date information, opportunities and events.

Find Out More

Digital skills and help finder

Provide every user and partner with dynamic self assessments; to discover the need, availability and progress of skills.

Find Out More

Tenancy sustainment tool

Deliver local advice and referrals through a case management platform tailored for tenants at risk of losing their home.

Find Out More

Venue Accreditation Tool

Provide training and resources for your venue and staff to become accredited in accessibility and service standards.

Find Out MoreLatest News & Updates

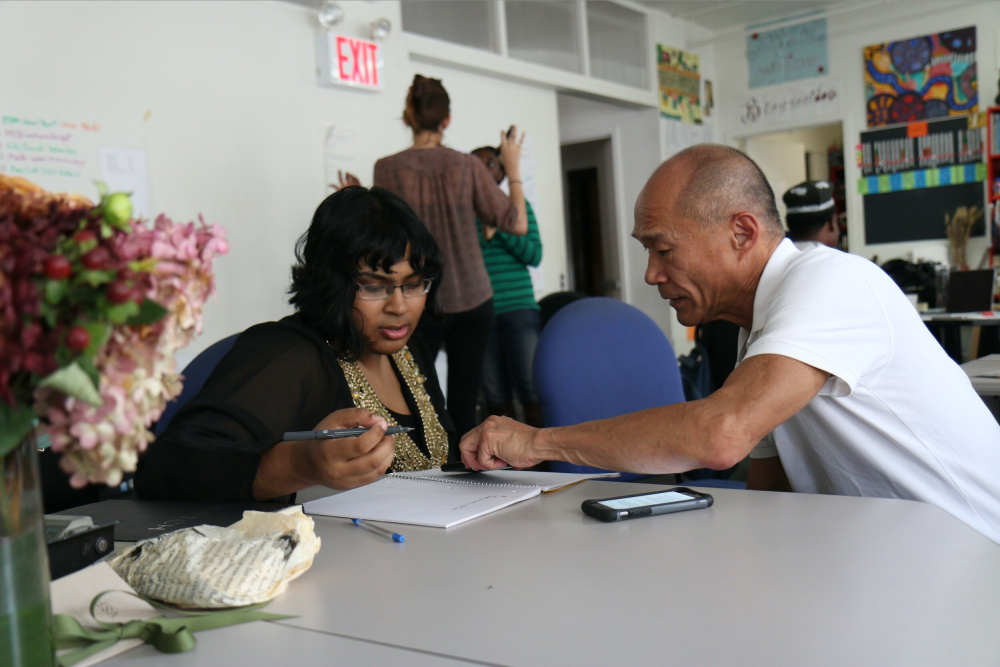

New partnership with the Southbank Centre

Mortar chosen to design new platform for children and young people, improving access into creative health opportunities.

Read More →

Selected to present at The Innovation Zone

Mortar selected by PUBLIC and the LGA as a cutting-edge startup applying technology to transform local services.

Read More →

Successful appointment onto G-Cloud 14 Framework

Mortar has become a supplier on the Crown Commercial Services G-Cloud framework, the largest framework in the UK.

Read More →Mortar has been featured, recommended, and accredited by the following organizations:

Insights

Explore our insights to find out how we are applying new technology to build better services.

-

Driving product developmentWhy user-led design principles drive the benefits and efficiencies of our solutions.

-

Intelligent User PathwaysTransition services into more effective methods of delivery using our triage and referral tools.

-

Dynamic Information DirectoriesStructuring information to transform customer engagement and power more efficient services.

-

Custom engagement environmentsEmpower local networks and services with custom-designed environments that enhance service delivery outcomes.

-

Improving AccessibilityBuild accreditation processes with digital tools. Driving accessibility, scalability, and engagement.

-

Supporting Young PeopleEmpower educators with quick and effective tools for assessing and referring young people at risk of exclusion.

-

Improving Digital InclusionTransform local area services with tools that assesses exclusion, provides tailored referrals, and enhance access to resources.

-

Reaching Isolated ResidentsCombat isolation and improve outreach with user-led communication tools that connect residents to community services and cultural initiatives.

-

Better data, bigger impactUnlock the potential of data with intelligent environments that drive more impactful decision-making.

-

Working smarter, not harderRevealing hidden patterns offers stepping stones to improving service delivery through intelligent tools.

-

Designed for co-creationCo-create digital solutions that transform services through custom tools, interfaces, and flexible environments.

-

Simple SuccessesHow simple solutions can achieve great impact by improving the accessibility and sharing of service information.

-

Exclusion and OverloadAddress exclusion by creating accessible, tailored tools that connect users to essential services and reduce barriers to access.

-

Hyperlocal transformationEmpower local services with digital tools that enhance engagement, information sharing, and improve frontline service delivery.

-

The art of conversationTransform local area engagement with personalised communication tools that deliver meaningful, timely information.

-

Truth, transformation and real estateDigital transformation in real estate should be powered by user-driven innovation to enhance local area engagement.

-

Creating connectionsTransform property relationships with tools that enhance communication, transparency, and engagement in tenant and occupier interactions.

-

Service mapping for HackneyUsing digital platforms to enhance communication and improve access to information for targeted residents.

-

Collaborate and co-createAccelerate digital transformation through real-time data and AI-powered collaboration.

-

Driving the role of dataEnhance data sharing, consent management, and real-time analysis with unified data environments that streamline decision-making.

-

The power of balanceEmpower tenants with self-service tools that foster equitable communication, collaboration, and sustainable relationships.

-

The speed of resilienceFocusing on early intervention to foster more constructive relationships between creditors and debtors.

-

Evolving the finance functionTransform operations with AI-driven solutions that streamline processes, eliminate manual tasks, and drive strategic business growth.

-

Understanding automationEmbrace automation and machine learning to unlock new opportunities, navigate uncertainty, and shape the future of business and property.

-

Building better collectionsEnhance revenue with AI-powered tools that unify financial data, automate collections, and improve customer engagement.

-

What does impossible look like...How navigating the future requires transparency, flexibility, and collaboration to build a more resilient and adaptable sector.

-

Markers of growthExploring the impact of the pandemic on business growth, technology adoption, and the long-term challenges facing communities.

-

Transform traditional financeHow real-time data and automated allocation increases productivity and transparency.

-

Scaling upDiscover how Mortar worked with PwC to refine its market positioning, strategy, and product development.

Get in Touch

Interested in learning more about one of our products or tools, need technical support, or want to discuss a project? Fill out our form and we will be in touch with you soon.

Or, skip the form and send us an email:

office@mortar.works