Transform traditional finance

Transform traditional financial processes with easy-to-use interfaces and AI assisted decision making

Financial integrity is at the heart of Mortar. It is why we are so committed to making AI more accessible and easy to adopt. Financial integrity means your team members and stakeholders having trust and confidence in their actions and decisions, through all having access to the same accurate, real-time information on accounts, invoices and bills at any moment in time, across any part of the financial pipeline.

Automation and artificial intelligence are poised to reshape the finance function. Knowing what to automate and managing the disruption can lead to a new era of productivity and performance. Frank Plaschke, Ishaan Seth, and Rob Whiteman; partners at McKinsey & Company

Mortar provides access to real-time financial information and uses its AI engine to improve your supplier, client and consumer relationships, as well as increase employee productivity and team morale. Real-time financial information is essential for undertaking successful digital transformation projects, evolving the delivery of cloud and web based services, and enabling the introduction of intelligent products and applications to engage your consumers and clients.

For these reasons Mortar has made it easy and simple for your treasury and finance teams to start implementing AI, to benefit from real-time, accurate financial information.

Intelligent interfaces for the finance team

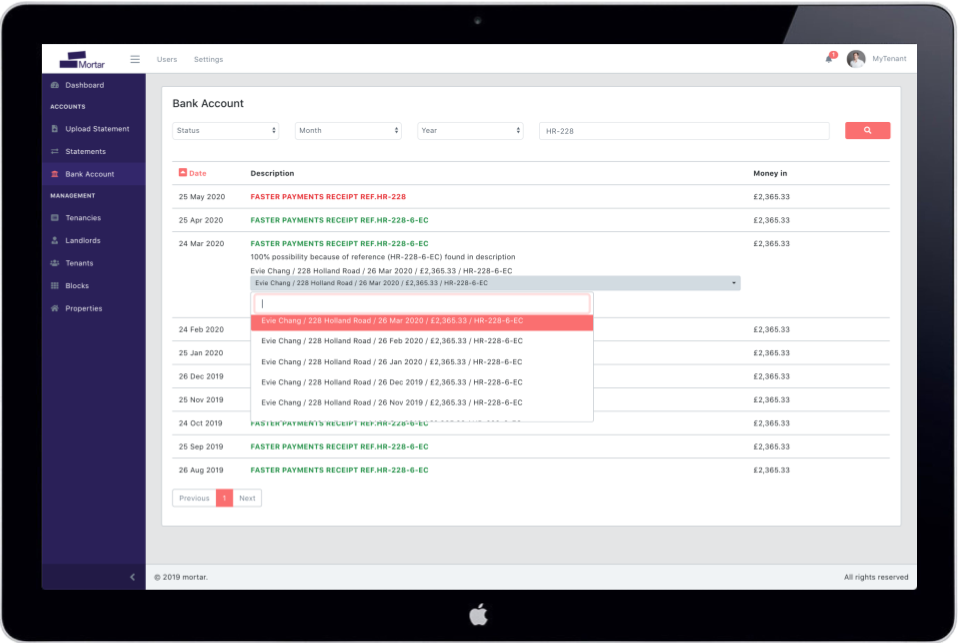

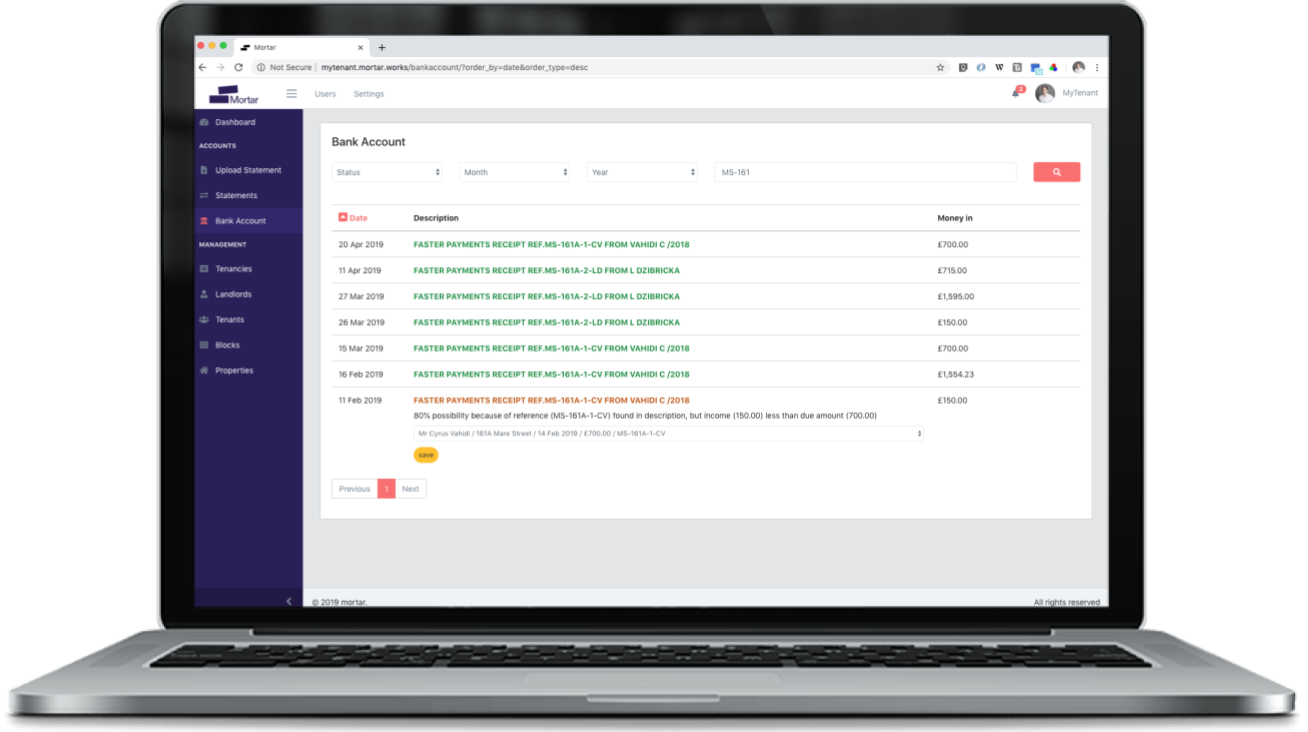

Payment allocation is the first point at which automation and machine learning can start to augment employee roles and decision making, aiding the drive towards financial integrity. Mortar's intelligent payment allocation system provides a connected set of user interfaces for treasury team members, turning them into AI assisted decision makers, freeing up thousands of hours of time to concentrate on higher value tasks and responsibilities.

A simplified financial system

It is common for treasury teams to be required to handle and organise multiple sources of information. Team members have to refer to both billing and invoicing; accounts receivable and accounts payable; bank account data as well as customer relationship management tools; to be able to ascertain the correct allocation of a payment.

Mortar simplifies this complex financial system, creating a unified layer of financial information and combining data sources into a single user interface. Mortar's universal data adaptor obtains and organises information, for our AI engine to provide companies with end-to-end billing, account and balance reconciliation, and intelligent payment allocation.

Applied automation and machine learning

54% of executives say that AI solutions have already increased productivity in their businesses. These leaders are using AI to automate processes too complex for older technologies; to identify trends in historical data; and to provide forward-looking intelligence to strengthen human decisions. PwC, How can organisations reshape business strategy with AI?

Core financial processes are often neglected when it comes to digital transformation. The work of your treasury, finance and income teams however is fundamental to improving engagement and service provision, and offers the ideal environment to augment roles and drive productivity with automation and machine learning.

Get in touch to learn more about our intelligent treasury systems and how Mortar can provide you with the access to accurate, real-time information your company needs to evolve.